Corporate Governance

- Index

- Investors

- Corporate Governance

- Shareholder Q&A

Shareholder Q&A

Company Information

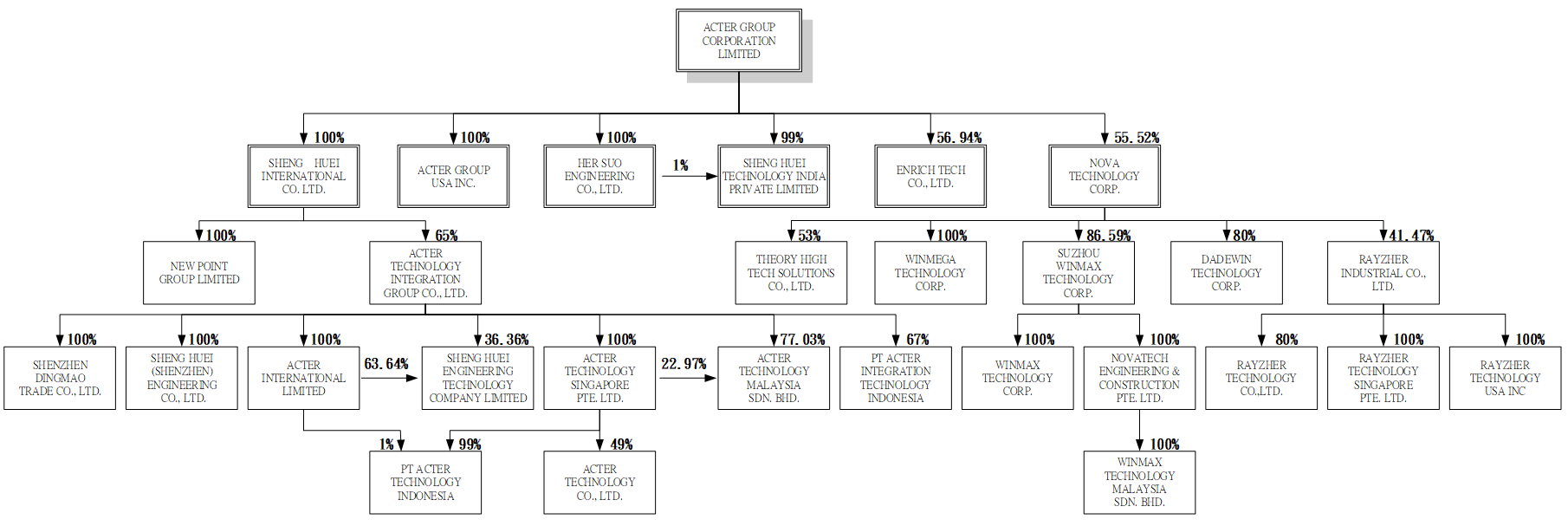

What is the shareholding ratio of each subsidiary?

What is the company’s dividend policy?

The dividend policy according to the Article of Incorporation provides as follows:

The company’s surplus earning distribution or loss off-setting proposal may be proposed after the end of each half fiscal year.

When distributing the surplus earnings for each half fiscal year, the company shall first estimate and reserve the taxes to be paid, offset its losses, estimate and reserve the amount of employees’ and directors’ compensation, set aside or reverse a legal capital reserve at 10% of the remaining earnings provided that the amount of accumulated legal capital reserve has not reached the amount of the paid-in capital of the company, then set aside a special capital reserve in accordance with law and the competent authority.

If there is a balance left over, the balance, together with the accumulated undistributed surplus in the previous period, shall be drafted by the board of directors for a distribution proposal. When the company distributes its surplus by issuing new shares, it shall follow the Article 240 of the Company Act; if such surplus is distributed in the form of cash, it shall be resolved by a majority vote at a board of directors meeting attended by at least two-thirds of the total number of directors.

If there is a surplus earning following annual closing, the company shall first pay the taxes and offset its losses, then distribute it in the following order:

- Set aside a 10% legal reserve. Where such legal reserve amounts to the total paid-in capital, this provision shall not apply;

- Special reserve in accordance with law and the competent authority.

- If there is a balance left over, the balance, together with the accumulated undistributed surplus in the previous period, shall be drafted by the board of directors for a distribution proposal. When the company distributes its surplus by issuing new shares, it shall be resolved at the shareholders’ meeting; if such surplus is distributed in the form of cash, it shall be resolved by a majority vote at a board of directors meeting attended by at least two-thirds of the total number of directors and shall be reported to the shareholders’ meeting.

In accordance with the Article 241 of the Company Act, when the company distributes its legal reserve and the capital reserve, in whole or in part, by issuing new shares or by cash distribution which shall be distributed as dividend shares to its original shareholders in proportion to the number of shares being held by each of them, it shall be distributed in accordance with the resolution in the preceding paragraph.

The company reserves a portion of the surplus depending on its current environment, growth stage and long term financial planning. The remaining amount will be distributed by the board of directors as shareholder dividend based on the capital situation and economic development of the current year and cash dividend shall account for 10% or more of the total shareholder dividend.

The board of directors shall set out the company’s dividend policy based on the operational performance and the need of capital. When the company distributes its surplus by issuing new shares, it shall follow the Article 240 of the Company Act; if such surplus is distributed in the form of cash, it shall be resolved by a majority vote at a board of directors meeting attended by at least two-thirds of the total number of directors. According to the resolution of board, the distributed shareholder dividend would be not less than 51% of the current undistributed profit. Besides, cash dividend should account for 10% or more of the total shareholder dividend. Please refer to M.O.P.S website for more information.

When is the high season or low season for Acter?

Acter has no obvious high season or low season due to the characteristics of industry. Only in the first quarter, revenues would be in the low level cause of more national holidays and less work days.

How does Acter recognize revenues?

Revenues of Acter group mainly come from construction and sales (equipment). Construction contract revenue is determined based on the percentage of completion method. The extent of completion is determined based on contract costs incurred for work performed to date in proportion to the estimated total contract costs. Any expected excess of the total contract costs over the total contract revenue will immediately be recognized as construction cost. On the other hand, revenue from the sale is recognized when persuasive evidence exists, usually in the form of an executed sales agreement, that the significant risks and rewards of ownership have been transferred to the customer, recovery of the consideration is probable, the associated costs and possible return of goods can be estimated reliably, there is no continuing management involvement with the goods, and the amount of revenue can be measured reliably.

Does Acter receive dividends distributed from its subsidiary Nova Technology Corp.? And will the dividends increase Acter’s profit?

Shareholders of Nova Technology Corp. that be stated in the register of shareholders on the ex-dividend date will receive dividends. Therefore, Acter will receive dividends based on the shareholding ratio as well.

Nova Technology Corp. is one of the Acter Group entities. Therefore, both revenue and profit of Nova Technology Corp. are included in the consolidated financial statements. When Acter receives dividends distributed from Nova Technology Corp., it does not affect Acter’s profit or the consolidated financial statements. It will only affect Acter’s cash flow when Nova Technology Corp. distributed cash dividends.

How to get the stock price of Acter?

Please go to the website of TWSE and input the stock number "5536" in the column of get stock on the right.